Insurance Retention

As in Insurance industry the cost of new customer acquisition is much higher than that of retaining the existing customers. As the costs of acquiring new customer is high, companies’ profits are in the persistency. ATS services which is founded by Banking Industry experts is consistent in delivering best-in-class customer engagement through Omni channel experience.

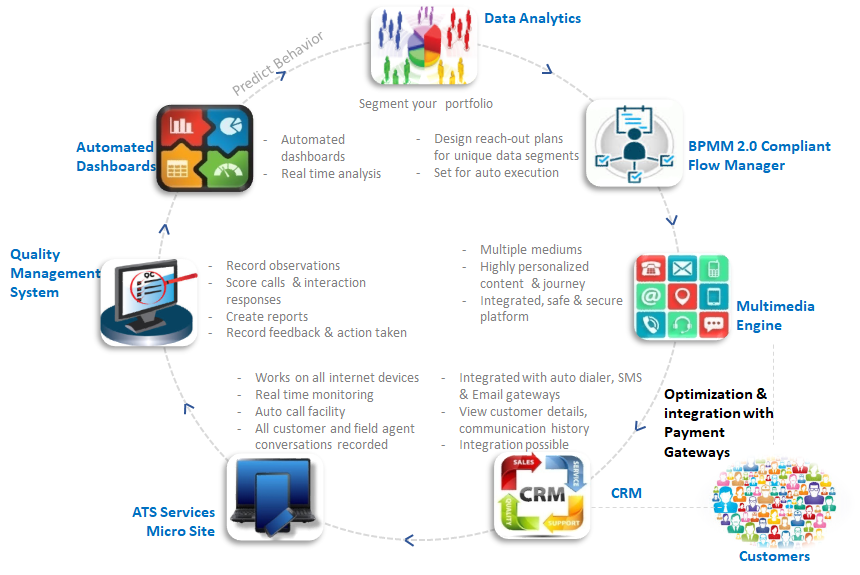

Our Approach

Data Analytics

From setting out the KPIs measurement and past trending we initiate the benchmarking with the basic analytics.

Reach out Plans

We design the customer reach out plans for targets data segments and are set for auto execution.

Multimedia Treatments and Payment Gateways

Customers are communicated through various communication channels through integrated and secure platforms including payment gateways.

CRM

Our CRM is integrated with Dialer, SMS and payment gateways, allowing to create a digital trail of contacts attempts along with conversations logs and intelligently route inbound/outbound and IVR calls.

Quality Management System

We have our own automated system that evaluates calls and ensures continuity of performance though effective feedback mechanism. The tele-caller’s performance is monitored and evaluated and for operational consistence and continuous improvement.

Automated Dashboards and Analysis

We have automated performance management system which consist of Operational, Analytical and Strategic Dashboards. Out team monitors and tracks the data behaviours if these are aligned with the organizational goals. These dashboards are the key factors for data treatments and strategy mending.