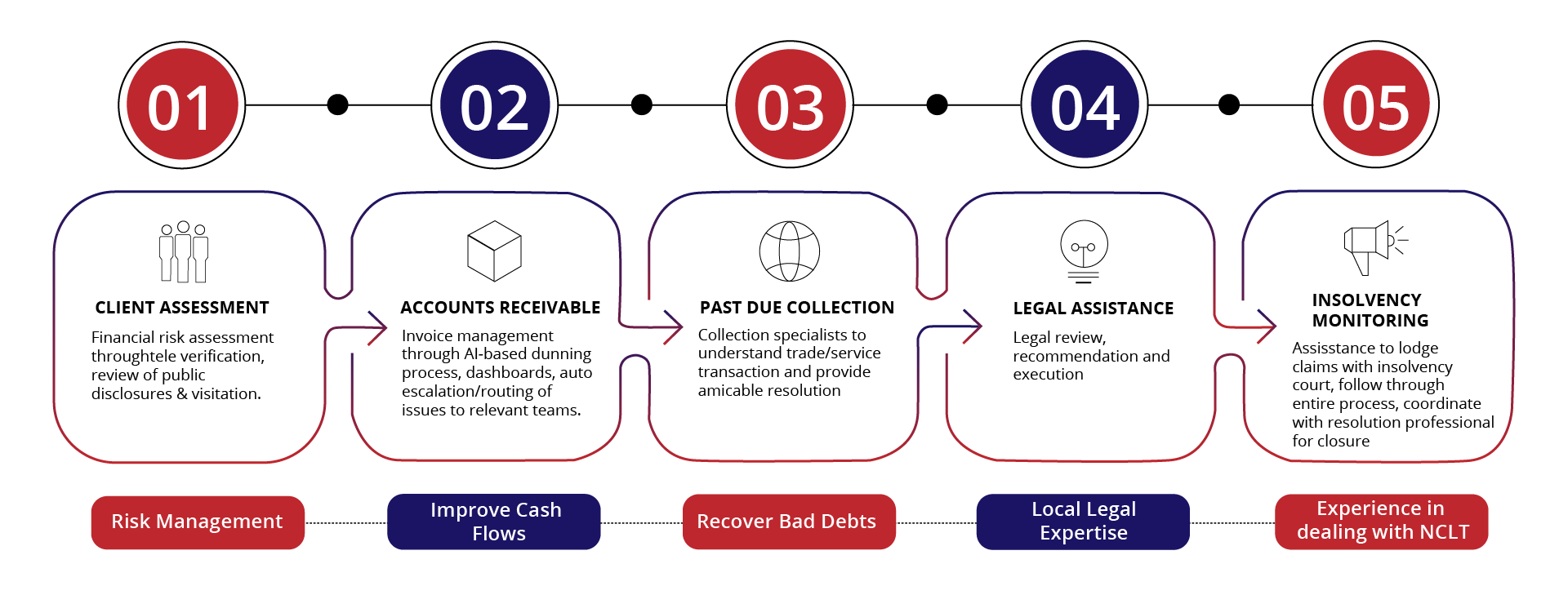

Our Approach

Credit/Risk Assessment

This assessment is aimed at evaluating financial stability, business continuity, and other incidental information provided by the customer. The purpose of this assessment is to avoid or reduce credit exposure to riskier customers.

Order to Cash

Invoice is given to us on the date of generation and our effort here is to improve the credit cycle and reduce write-offs. This is done via automation of the dunning process and providing people support as necessary.

Past Due Collections

For longer-term outstanding receivables, our methodology is to facilitate a settlement by understanding the transaction, working with both, debtor and creditor in establishing an agreeable baseline, and negotiating a concrete conclusion.

Legal

Where amicable resolution is not possible we provide support in litigation. This includes legal assessment and strategy recommendation, initiating legal notices, filing recovery suits, and winding-up petitions.

NCLT Monitoring

Cases where Banks or other creditors have approached the National Tribunal to put the company into bankruptcy and either sell it or liquidate it. We provide assistance in terms of lodging of claims and regular monitoring of the status.

Solvency Check

In cases where the client is unsure of the debtor’s capability to pay we do a financial review and assessment of the debtor as the solvency of the debtor. This is extremely helpful in deciding the next steps with respect to the pursuance of a claim.

Visitation

PAN India visitation can be arranged on specific cases as per the requirement with prior client approval. We provide a visitation report, this can be extended to doing a physical check of the premises, material, office condition as per client requirement.

Our B2B Debt Collection Agency Partners Include