Retail Collections

Our Retail collections expertise has been built over the years. We handle all retail banking products such as mortgages, auto, two-wheeler, durable and unsecured loans, and credit cards.

Our success in collections is largely predicated on our capability in risk analytics and technology, which enables us to develop appropriate collection strategies as well as to monitor the campaigns.

Our Approach

Data Analytics

Data is segmented in different portfolios doing the basic analysis. From setting out the KPIs measurement and past trending we initiate the benchmarking.

Reach out Plans

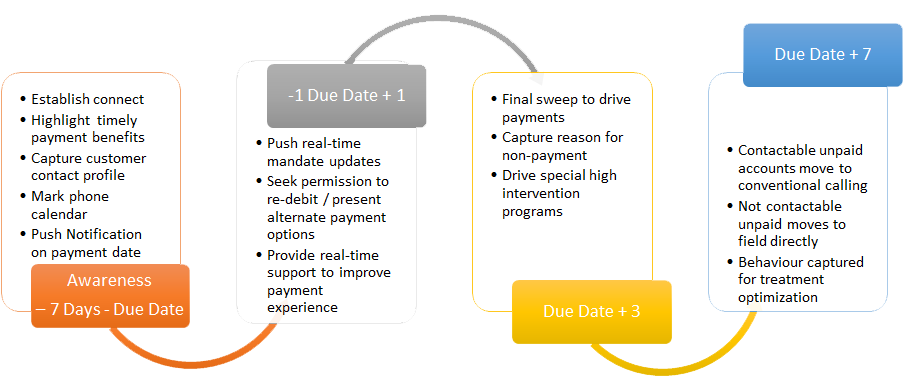

We design the customer reach for unique data segments and the Strategy is made for auto execution on customer reach out plan

Multimedia Engine

Customers are communicated through various communication channels with highly personalized content throughout the journey through the integrated, safe and secure platform

CRM

Our CRM is integrated with Dialer, SMS and payment gateways, allowing to create a digital trail of contacts attempts along with conversations logs and intelligently route inbound/outbound and IVR calls.

ATS Services Microsite

Each customer has personalized microsite (through which the real time customer behaviour from auto calls facilities to filed agent conversation is captured.

Quality Management System

In cases where the client is unsure of the debtor’s capability to pay we do a financial review and assessment of the debtor as the solvency of the debtor. This is extremely helpful in deciding the next steps with respect to the pursuance of a claim.

Automated Dashboards and Analysis

We have automated performance management system which consist of Operational, Analytical and Strategic Dashboards. Out team monitors and tracks the data behaviours if these are aligned with the organizational goals. These dashboards are the key factors for data treatments and strategy mending.